SAO PAULO, BRAZIL – Brazilian meatpacker JBS SA posted a first-quarter profit that beat expectations on the back of strength in its United States business, according to a financial statement on Wednesday.

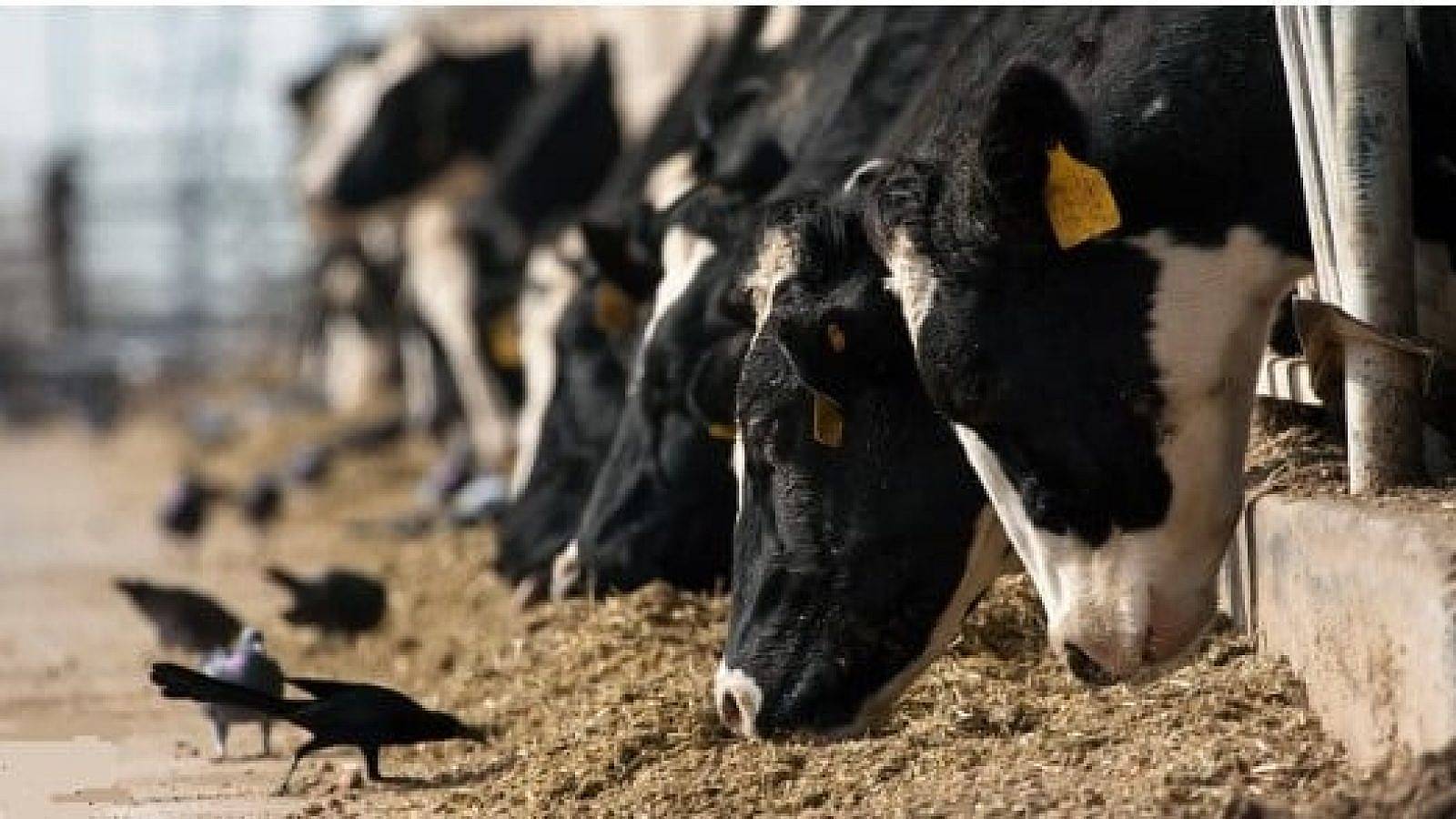

Despite posting a 151.4% increase in profit, high global grain prices and Brazil’s sluggish economy challenged the world’s biggest meat company, in addition to an expected drop in pork exports to China, reports Reuters.

JBS made 5.14 billion reais ($1.00 billion) in profit after reporting net sales 20.8% higher at 90.8 billion reais.

Beef operations in North America remained strong, with net revenue rising almost 22% thanks to heated domestic demand, the recovery of food service channels and healthy retail sales, which also bolstered JBS’s chicken business in the region.

The United States is also a major export platform for JBS.

During the quarter, and despite the slowness of some U.S. port operations, the company said beef export volumes rose by more than 6% from the country.

JBS also said Asia continues to be the most important region for exports of U.S. beef, notably China, which in the period increased beef import volumes by almost 62%.

On the other hand, the company said U.S. pork exports to China slumped, with the United States now ranking fifth as the main supplier of that type of meat to the Asian country.

JBS was among meat packers called to testify at recent House and Senate Ag Committee hearings on alleged concentration in and price fixing of the beef market in the U.S.

The four CEOs — David MacLennan of Cargill, Tim Schellpeper of JBS USA Holdings Inc., Tim Klein of National Beef Packing Co. LLC and Donnie King of Tyson Foods — said that larger economic and market forces (supply chain disruptions, labor shortages and a spike in demand) have been responsible for fluctuations in the cattle markets and soaring consumer retail prices.

Together, the companies control more than 80 percent of the beef market.

The hearings, held April 27-28, were called due to complaints from some ranchers that concentration in the meat industry and anticompetitive practices have made it difficult for them to make a living and led to a decline in the number of independent ranches in recent years.

The hearings titled “An Examination of Price Discrepancies, Transparency, and Alleged Unfair Practices in Cattle Markets,” were called in response to the financial hardships experienced by cow/calf producers and feeders, at the same time meat processors are making record profits.

While the CEOs of the big four meatpacking companies denied accusations of price-fixing at the hearings held April

Last year, Tyson agreed to pay $221.5 million to settle accusations of conspiring to inflate chicken prices. Under the settlement, Tyson avoided admitting liability, as the company pointed out in a filing with the Securities and Exchange Commission.

JBS in February agreed to pay $52.5 million to settle a lawsuit brought by grocery stores and wholesalers accusing the big four meatpackers of conspiring to drive up beef prices. The company did not admit wrongdoing.

In 2020, Pilgrim’s Pride, a subsidiary of the Brazilian-owned JBS parent company, pleaded guilty to fixing the price of chicken products and paid a $110 million fine to the Justice Department.